AI Sentiment: Bearish

Reason: The article discusses a significant drop in the value of Hedera Hashgraph's HBAR, Filecoin (FIL) and Uniswap's UNI tokens, indicating a generally bearish trend within the digital asset market.

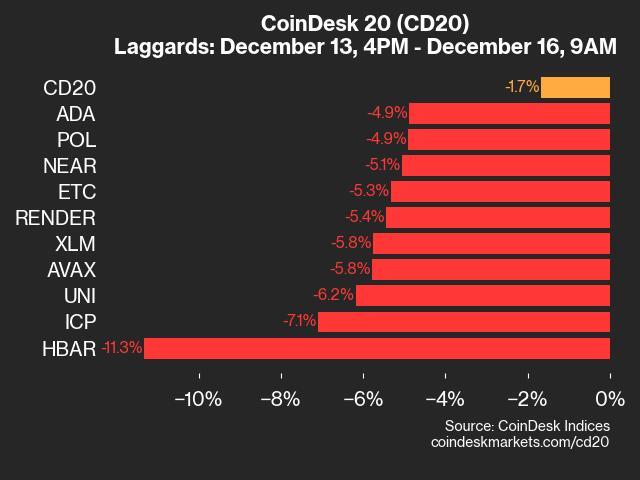

Over the weekend, the cryptocurrency index took a hit, with Hedera Hashgraph's HBAR falling by 11.3%, leading the downturn. This significant drop contributed to the overall decline of the index. This drop in HBAR's price came after a week where it had initially shown some promising signs of recovery. Despite the drop, HBAR remains one of the top 20 digital assets by market capitalization.

Other cryptocurrencies also experienced a slump over the same period. Filecoin (FIL) and Uniswap's UNI tokens were not spared, with their prices falling by 10.2% and 9.9% respectively. This indicates a generally bearish trend within the digital asset market. However, not all digital assets saw a decrease in value. Bitcoin (BTC) and Ethereum (ETH), the two largest digital assets by market capitalization, experienced only minor losses of 0.6% and 1.1% respectively.

On a more positive note, some digital assets did manage to buck the trend and saw their prices increase. For instance, Cardano's ADA and Chainlink's LINK tokens each saw an increase of 3.8% and 1.9% respectively. This demonstrates that despite the overall bearish trend, some digital assets can still perform well and provide positive returns for their investors.

The recent movements in the digital asset market illustrate the volatility and unpredictability inherent in this space. Investors need to stay informed and keep up with the latest market trends to make effective investment decisions. Despite the volatility, digital assets continue to attract investors due to their potential for high returns and the growing acceptance of cryptocurrencies in the global financial system.