AI Sentiment: Very Bullish

Reason: MicroStrategy is aggressively increasing its Bitcoin holdings and maintaining a bullish view, despite market volatility. Its inclusion in the NASDAQ-100 and its Bitcoin acquisition strategy are drawing significant attention and investment.

Technology firm MicroStrategy has increased its Bitcoin holdings to 124,391 BTC, further cementing its position as one of the largest corporate holders of the cryptocurrency. Following its inclusion into the NASDAQ-100, the company purchased an additional 1,914 Bitcoin, valued at roughly $94.2 million.

The NASDAQ-100 index is a collection of the 100 largest non-financial companies listed on the NASDAQ, based on market capitalization. Inclusion in this index is often seen as a measure of success and stability, and is typically accompanied by increased interest from investors. MicroStrategy's inclusion in the NASDAQ-100 signals its continued growth and the increasing acceptance of Bitcoin as a viable asset.

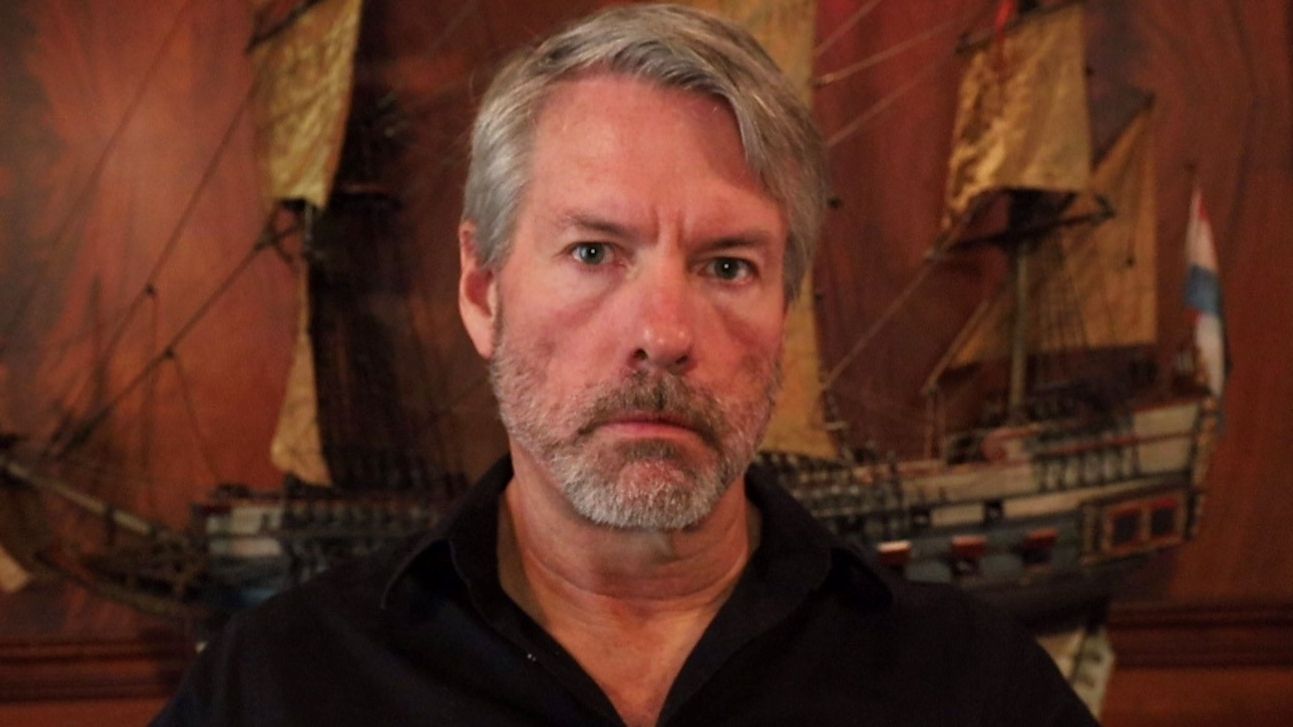

MicroStrategy has been a strong proponent of Bitcoin, with CEO Michael Saylor often touting its benefits as a store of value and hedge against inflation. The firm's aggressive acquisition of Bitcoin has made it one of the largest corporate holders of the cryptocurrency, with its holdings now valued at over $5 billion.

Despite the volatility of the cryptocurrency market, MicroStrategy has maintained a bullish stance, viewing any dips in price as opportunities to acquire more Bitcoin. This strategy has been mirrored by other companies and high-profile individuals, further driving interest and investment in Bitcoin.

In addition to its Bitcoin holdings, MicroStrategy also provides business intelligence, mobile software, and cloud-based services. However, its aggressive pursuit of Bitcoin has drawn significant attention, leading to a surge in its stock price and its inclusion in the NASDAQ-100.

With Bitcoin increasingly being viewed as a legitimate asset, more companies are expected to follow MicroStrategy's lead in the future. This could potentially drive further growth in the cryptocurrency market and push Bitcoin prices to new highs.