AI Sentiment: Cautiously Bullish

Reason: The article is cautiously bullish as it highlights the significant growth in Bitcoin's value and potential increase in use of digital assets in the corporate world. However, it also mentions regulatory scrutiny and sustainability concerns as challenges facing the cryptocurrency industry.

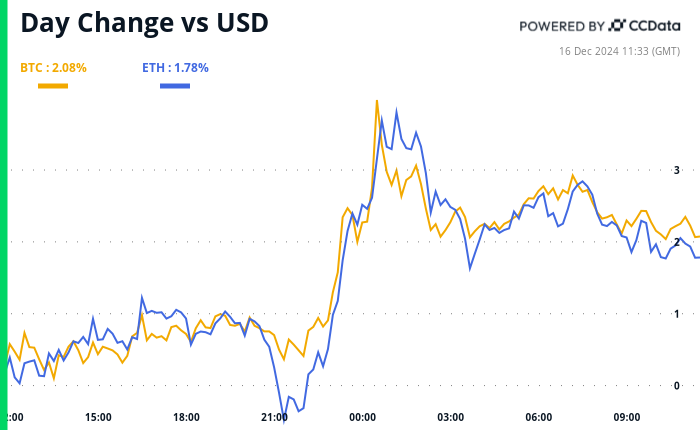

On Thursday, the value of Bitcoin surged beyond $106,000, marking a significant rise in the cryptocurrency market. This increase is associated with the implementation of a new accounting rule that is anticipated to boost the use of digital assets in the corporate world. The new rule allows companies to treat self-produced digital assets as 'intangible assets' rather than 'expense and deduction'. This change is expected to encourage more corporations to hold onto their digital assets for a longer period.

In addition, the Bitcoin market was also influenced by the Federal Reserve's decision to speed up the process of interest rate hikes in 2022. This move is aimed at curbing inflation, which has been rising at the fastest pace in 39 years. The hike in interest rates is believed to have led investors to seek out alternative investments like cryptocurrencies, thus driving up the demand and price of Bitcoin.

Meanwhile, other cryptocurrencies such as Ethereum experienced a similar surge, with its value reaching $4,170. This increase in value comes amidst the growing popularity of digital currencies and the adoption of blockchain technology in various sectors.

However, despite the positive market trends, the cryptocurrency industry continues to face regulatory scrutiny. The Securities and Exchange Commission (SEC) has expressed concerns about the potential risks associated with digital assets, particularly in relation to investor protection. The SEC has been actively working to establish comprehensive rules and regulations to govern the rapidly evolving digital asset market.

Furthermore, the cryptocurrency market is also facing challenges in terms of scalability and energy consumption. The massive energy required to maintain blockchain networks and process transactions is a major concern, especially given the increasing emphasis on environmental sustainability. As a result, many blockchain companies are exploring more energy-efficient alternatives to the traditional proof-of-work consensus mechanism.

In conclusion, while the cryptocurrency market is experiencing significant growth, it is also facing a variety of challenges. The new accounting rule and the Federal Reserve's decision to hike interest rates have contributed to the surge in Bitcoin and other cryptocurrencies. However, regulatory scrutiny, scalability issues, and concerns about energy consumption are still significant hurdles that the industry needs to overcome.