AI Sentiment: Cautiously Bullish

Reason: Despite a decrease in revenue and profit for Halliburton in Q4 2024, the company surpassed market expectations and remains optimistic for future recovery, with positive cash flow and a focus on operational efficiency and cost management.

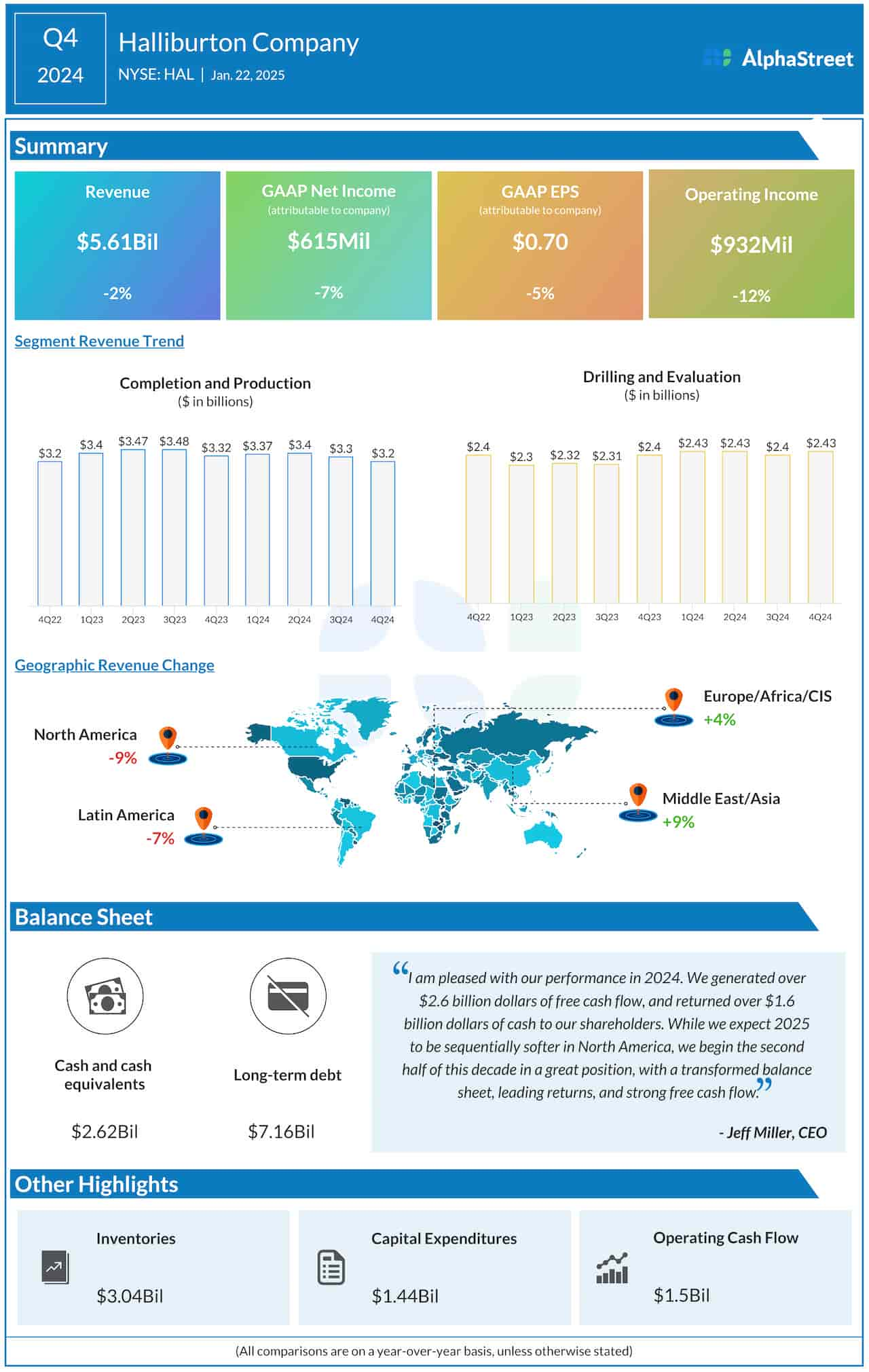

In a recent financial update, Halliburton, a leading oil field service company, reported a decrease in its revenue and profit for the fourth quarter of 2024. The company's revenue fell to $3.2 billion from $3.3 billion in the same period last year, reflecting a 3% decline. This decrease was primarily due to the impact of reduced activity in North America.

The Houston-based company's net income also declined, dropping to $160 million or 18 cents per share, compared to $194 million or 22 cents per share in the fourth quarter of the previous year. Despite these lower figures, the results surpassed the market's expectations, demonstrating the company's resilience amid challenging market conditions.

The completion and production division of Halliburton reported a 6% decrease in revenue at $1.8 billion. Meanwhile, the drilling and evaluation division's revenue stood at $1.4 billion, slightly up compared to last year.

Despite the decline in revenue and profit, Halliburton's free cash flow for the quarter was a positive $1.1 billion, fueled by aggressive cost management and improved operational efficiency.

The company's CEO, Jeff Miller, expressed optimism for the future, stating that the company is well-positioned for the eventual recovery of the global oil and gas market. He pointed to the company's strong operational performance and disciplined capital management as key factors in its ability to navigate the current market challenges.

In addition to its Q4 results, Halliburton also provided an update on its full-year performance for 2024. The company's annual revenue declined by 7% to $12.5 billion, while its net income stood at $459 million, down from $1.1 billion in 2023.

Despite the challenges experienced in 2024, Halliburton remains a crucial player in the oil field services industry. The company continues to focus on improving its operational efficiency, managing costs effectively, and positioning itself for a stronger performance as market conditions improve.