AI Sentiment: Very Bullish

Reason: Charles Schwab reported a significant increase in revenue and adjusted profit for the fourth quarter of 2024, driven by a rise in new brokerage accounts and client assets. The firm's strategic moves, strong client engagement, and robust balance sheet make it optimistic about future growth.

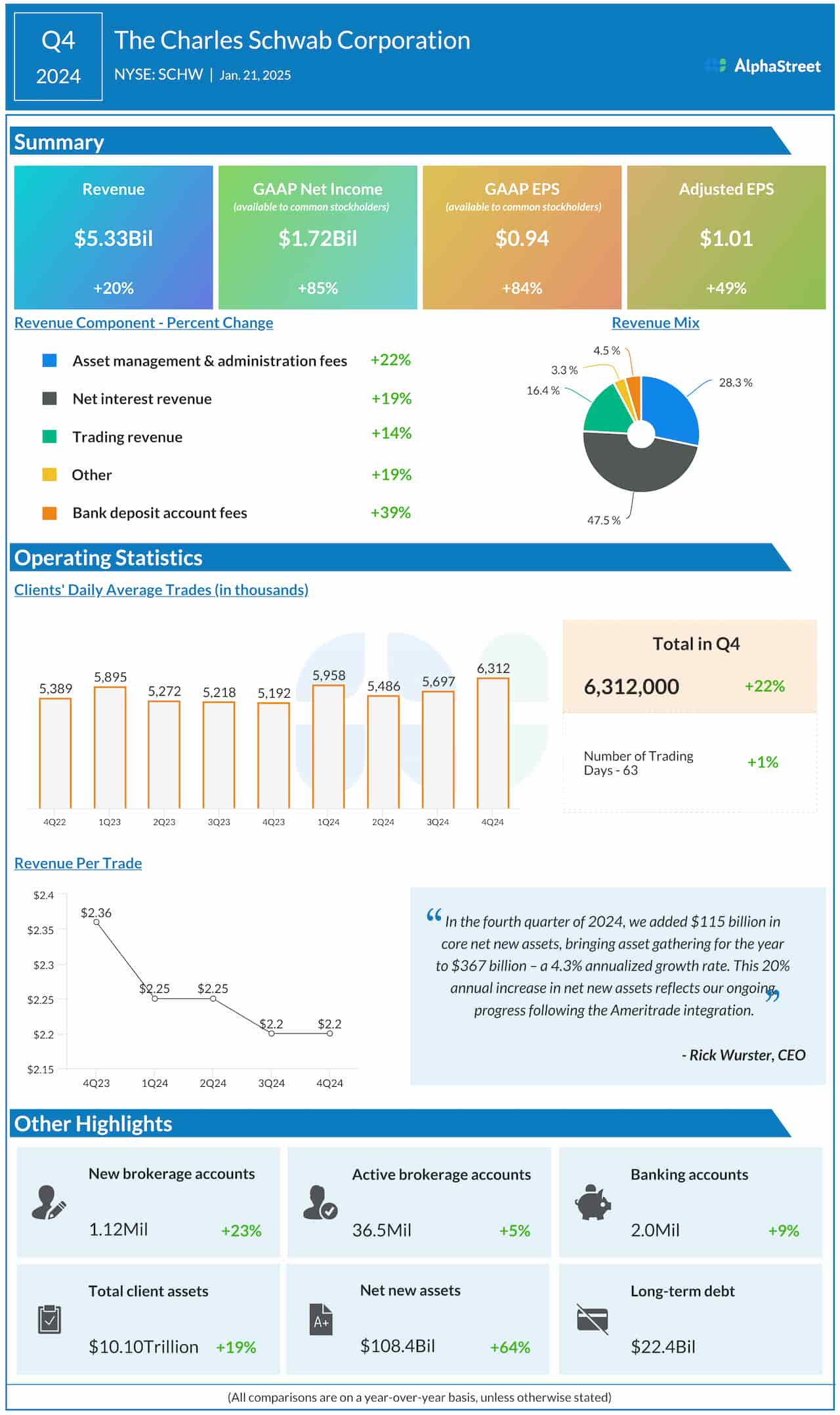

Leading financial services company Charles Schwab reported a notable increase in its revenue and adjusted profit for the fourth quarter of 2024. The growth in the company's financial performance can be attributed to a significant rise in new brokerage accounts and total client assets, according to the latest earnings report released by the firm.

In the fourth quarter, Charles Schwab's net income was $1.26 billion or $0.58 per share, compared to $1.14 billion or $0.52 per share in the corresponding period of the previous year. Its revenue for the period came in at $5.29 billion, an increase of around 14% from the same period in the previous year. The financial services giant's adjusted earnings, excluding certain items, was $0.64 per share for the quarter, beating analysts' estimates.

The firm's client assets reached a record high of $7.4 trillion at the end of December 2024, an increase of 13% from a year ago. The company opened 2.7 million new brokerage accounts in the fourth quarter, up 10% from the same period in the previous year. The firm's digital engagement also continued to grow, with mobile check deposits increasing by 20% year over year.

Charles Schwab has also made several strategic moves to enhance its growth prospects. These include the acquisition of TD Ameritrade, which is expected to provide significant scale benefits and cost savings. The company is also expanding its wealth management capabilities and digital offerings to meet the changing needs of its clients.

Going forward, the company expects its revenue growth to be driven by higher interest rates and increased client activity. While acknowledging the challenges posed by the ongoing pandemic, Charles Schwab remains optimistic about its growth prospects given its strong client engagement and robust balance sheet.

In conclusion, the strong performance of Charles Schwab in the fourth quarter of 2024 underscores the firm's resilience amid challenging market conditions. With strategic acquisitions, an expanding client base, and a focus on digital innovation, the company is well-positioned to continue its growth trajectory in the coming years.