AI Sentiment: Bullish

Reason: Despite global economic challenges, Citigroup surpassed market expectations, reporting a 17% increase in quarterly earnings and a rise in earnings per share. The CEO expressed confidence for continued growth in 2025.

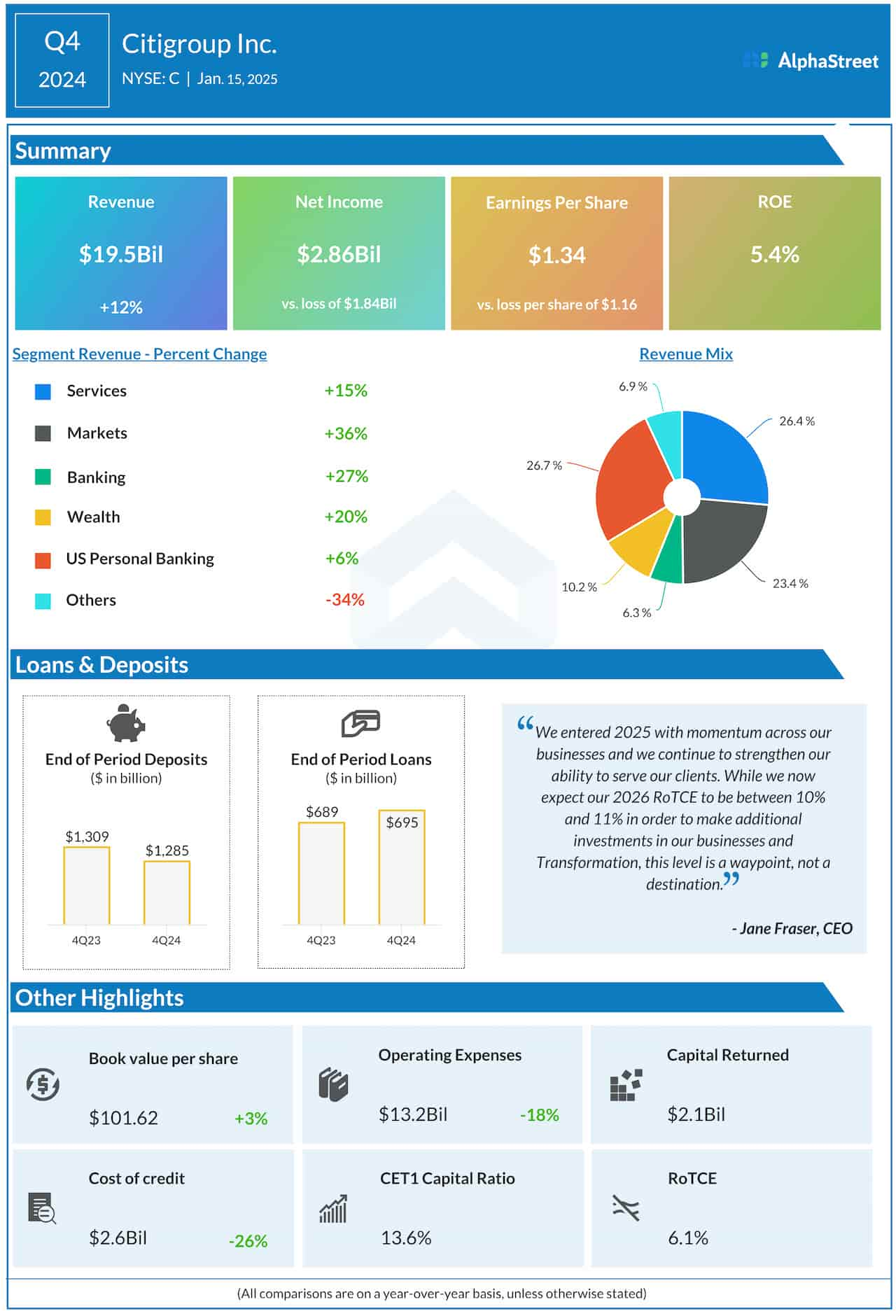

Citigroup has delivered a commendable performance in the fourth quarter of 2024, surpassing market expectations in terms of revenue and profit. The financial services multinational reported a 17% increase in quarterly earnings, demonstrating the strength and resilience of its diversified business model.

Despite the impact of the ongoing global economic challenges, Citigroup's earnings per share (EPS) rose to $2.07, exceeding the consensus estimate of $1.94. Meanwhile, revenue for the quarter amounted to $19.5 billion, defying market predictions of $18.8 billion. The company's solid performance can be credited to the impressive growth in its core businesses, namely the Institutional Clients Group and Global Consumer Banking, which saw revenue increases of 5% and 4% respectively.

Furthermore, the firm's net credit losses decreased by 11%, reflecting the success of its credit management strategies. The cost of credit for the quarter was down by $186 million, while the total net credit losses stood at $1.6 billion. Citigroup's efficiency ratio, a key measure of profitability, also improved from 57.1% in the third quarter to 56.2% in the fourth quarter.

Commenting on the results, Citigroup's CEO noted that the company's performance demonstrates its ability to support clients and communities while delivering robust shareholder returns. The CEO also expressed confidence in the company's strategy and the potential for continued growth in 2025.

However, the company's shares fell slightly in pre-market trading, indicating investor concerns over future growth amid global economic uncertainties. Nevertheless, Citigroup remains a strong player in the financial services industry, backed by its strong fundamentals and its commitment to delivering value to its shareholders.