AI Sentiment: Bullish

Reason: Goldman Sachs reported significant earnings growth for Q4 2024, surpassing market expectations with strong performance in global markets and asset management segments. Despite slight decrease in investment banking revenues, the outlook is positive due to diversification efforts.

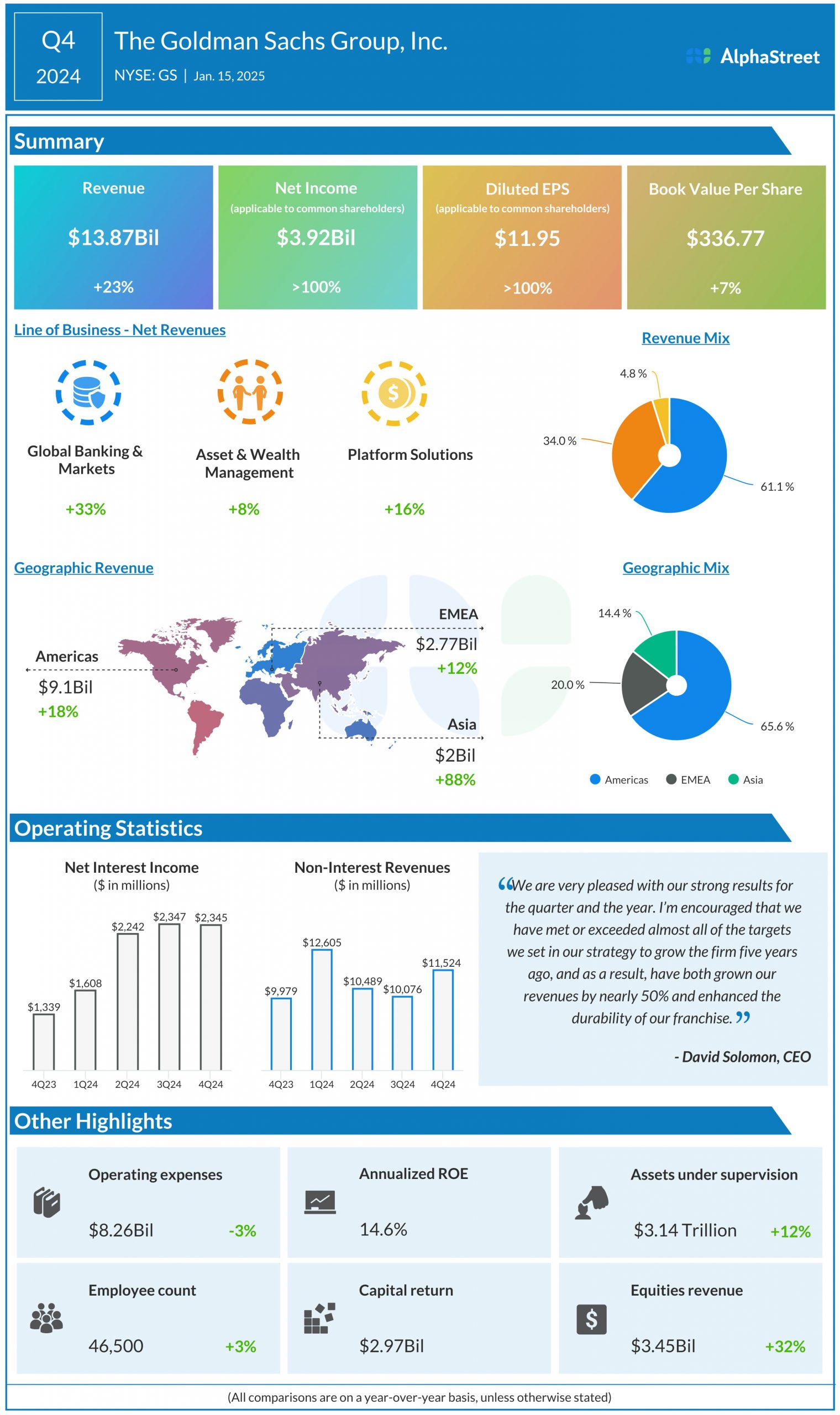

In a recent earnings report, Goldman Sachs revealed its financial results for Q4 2024. The multinational investment bank and financial services company reported a significant increase in earnings, surpassing market projections. The firm's impressive performance was largely due to its global markets and asset management segments, which showed robust growth. The results highlighted the company's ability to adapt and perform well during challenging economic conditions.

Goldman Sachs posted quarterly net earnings of $12.08 billion, or $33.53 per share, compared to $4.5 billion, or $12.08 per share, in the same period a year ago. This represented a growth of more than 100%, vastly outpacing analyst expectations of $10.10 per share. The firm's total net revenues also showed strong performance, amounting to $60.55 billion, up from $44.56 billion in the previous year.

The firm’s global markets segment reported net revenues of $24.31 billion, showing an increase from $13.29 billion in the previous year. This increase was primarily driven by significantly higher net revenues in Fixed Income, Currency, and Commodities (FICC) and Equities. The asset management segment also showed strong performance, with net revenues of $15.99 billion, up from $8.03 billion in the previous year. This increase was primarily due to higher incentive fees and equity investments.

Despite the overall positive results, the firm's investment banking segment reported a decrease in net revenues to $9.97 billion from $10.78 billion in the previous year. The primary reason for this decline was a decrease in Financial Advisory revenues.

Looking forward, Goldman Sachs is focusing on growing its consumer banking business. The firm launched Marcus, its consumer banking platform, in 2016 and has been steadily expanding its services since then. As the firm looks to diversify its revenue streams and reduce dependence on traditional investment banking operations, the focus on consumer banking is expected to continue.

In summary, Goldman Sachs' Q4 2024 report showed strong performance in most segments, with particularly robust growth in global markets and asset management. Despite a slight decline in investment banking revenues, the firm's focus on diversifying its operations and expanding its consumer banking platform points to a promising future.