AI Sentiment: Bullish

Reason: KB Home reported strong Q4 2024 results, with significant increases in revenue and profit. The CEO expects continued growth, backed by strategic measures, robust demand, and a solid foundation.

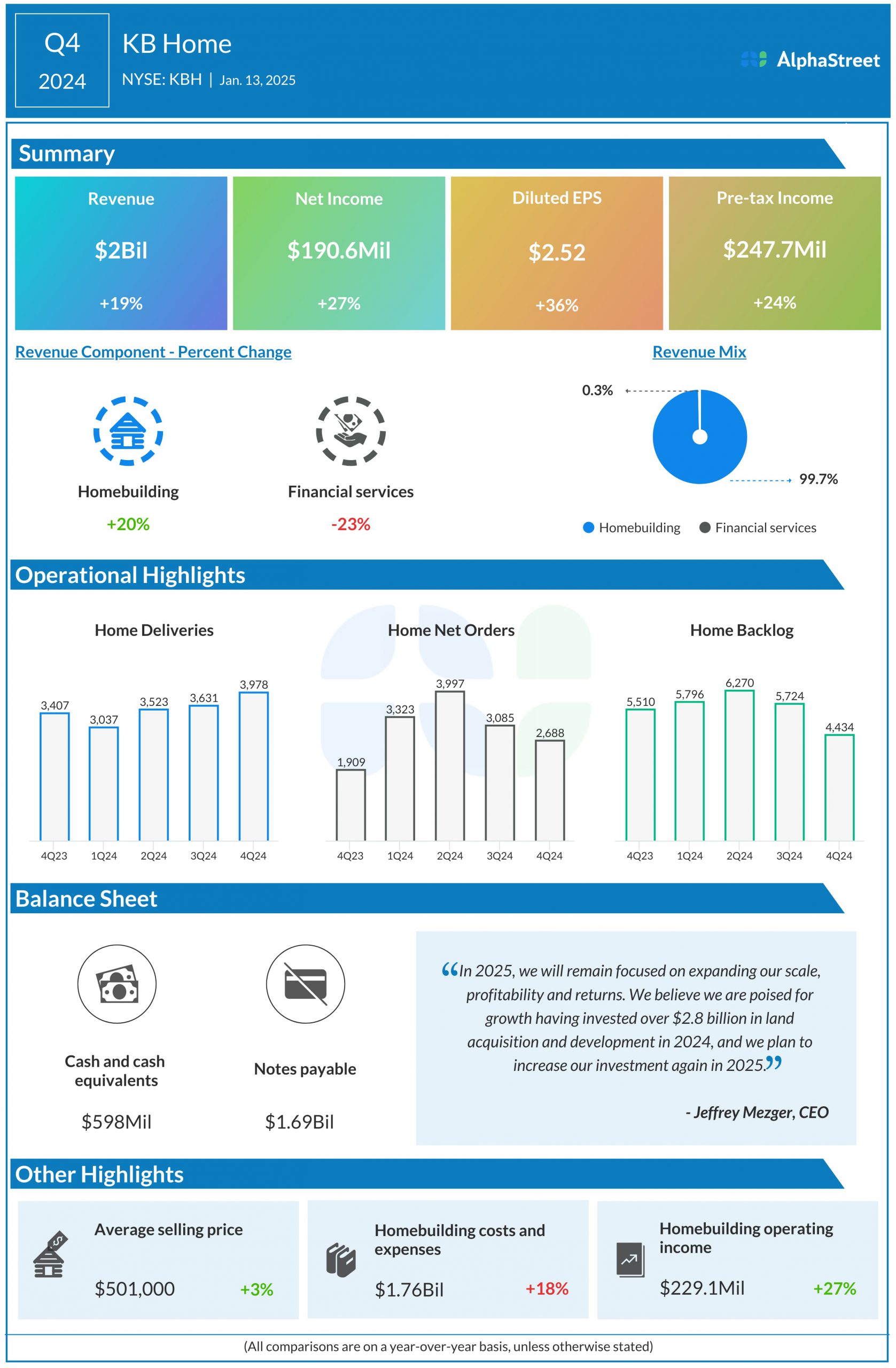

In its latest earnings report, renowned homebuilding company KB Home (KBH) showcased notable financial performance. The company reported solid results for the fourth quarter of 2024, demonstrating its resilience and adaptability in a challenging market environment.

The company's total revenues in Q4 2024 were $1.58 billion, a significant increase compared to the same period in the previous year. The net income attributable to KB Home was $123.2 million, or $1.31 per diluted share. This is in contrast to the net income of $106.1 million, or $1.12 per diluted share, reported in the fourth quarter of 2023.

The homebuilding revenues for the period stood at $1.57 billion, while the housing gross profit margin was 20.5%. The average selling price of the company's homes was $427,400. The company's financial services and insurance operations also contributed significantly to the overall revenues.

The company's CEO, Jeffrey Mezger, expressed satisfaction with the results, attributing the company's strong performance to strategic operational measures, effective cost management, and a robust demand for their homes. He also stated that the company is well-positioned for 2025 and beyond, with a strong balance sheet and a healthy backlog of orders.

The company's strategies, such as its focus on first-time buyers and its land investment strategy to support future growth, have been instrumental in its financial performance.

Looking ahead, KB Home expects to continue its upward trajectory, driven by a strong housing market and a commitment to delivering exceptional value to its customers. The company's robust financial results underscore its ability to navigate market challenges and capitalize on opportunities, providing a solid foundation for future growth.