AI Sentiment: Bearish

Reason: The article reports a significant downswing in the digital currency market, with nearly all core assets, including Render, Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Chainlink, trading at lower values. The market is described as volatile.

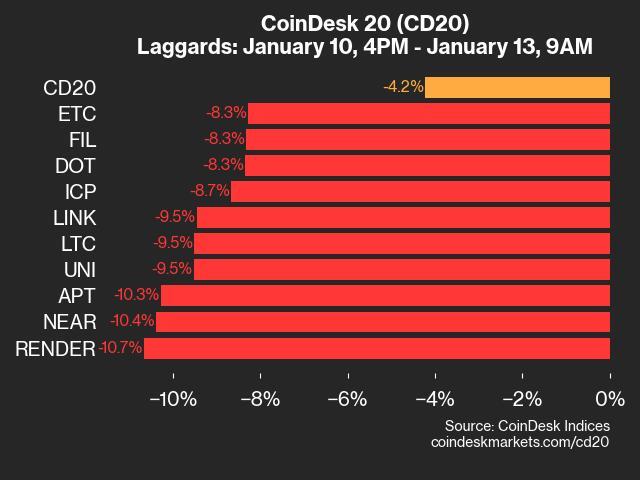

The digital currency market experienced a significant downswing recently, with nearly all core assets trading at lower values. Ranked 20th, the digital token, Render, saw a dramatic decline of 10.7% which was the largest decrease across all assets. One of the key factors influencing this downturn can be attributed to the overall pessimistic sentiment across the broader market.

Other digital currencies like Bitcoin, which is often seen as the industry standard, also experienced a decline, albeit a smaller one at 0.2%. This mild fluctuation is a testament to Bitcoin's resilience and its established reputation in the digital currency market. Equally, Ethereum, another major player in the industry, saw a decline of 0.8%, demonstrating similar resilience to Bitcoin.

Besides Bitcoin and Ethereum, other significant digital tokens also experienced a downturn. Litecoin, known for its swift transaction times, dropped by 0.9%, while Bitcoin Cash, a spin-off of Bitcoin, decreased by 0.7%. The digital token Chainlink, which enables smart contracts to connect with real-world data, also fell by 0.8%.

Despite the broad market downturn, there were a few exceptions. The digital currency Uniswap, which facilitates automated transactions between cryptocurrency tokens on the Ethereum blockchain, saw a slight increase of 0.2%. This highlights Uniswap's potential stability in the face of a turbulent market.

Overall, the recent trends indicate a volatile period for the digital currency market. However, as history has shown, these fluctuations are part and parcel of the digital currency landscape. As such, investors and traders need to monitor market trends closely and make informed decisions based on comprehensive analysis of the prevailing market conditions.