AI Sentiment: Bullish

Reason: The article is bullish on Conagra Brands (CAG), stating that despite facing challenges like inflation and increased price competition, the company has reported strong quarterly results, has a robust brand portfolio and is successfully navigating difficulties through innovation and strategic moves.

In the midst of a challenging business environment, Conagra Brands (CAG) is making significant strides. The company, known for its substantial presence in the packaged foods industry, has been facing a variety of difficulties, including increased price competition and the impact of inflation. However, Conagra's strong portfolio of brands, which includes names like Duncan Hines, Birds Eye, and Slim Jim, is helping the company navigate through these obstacles.

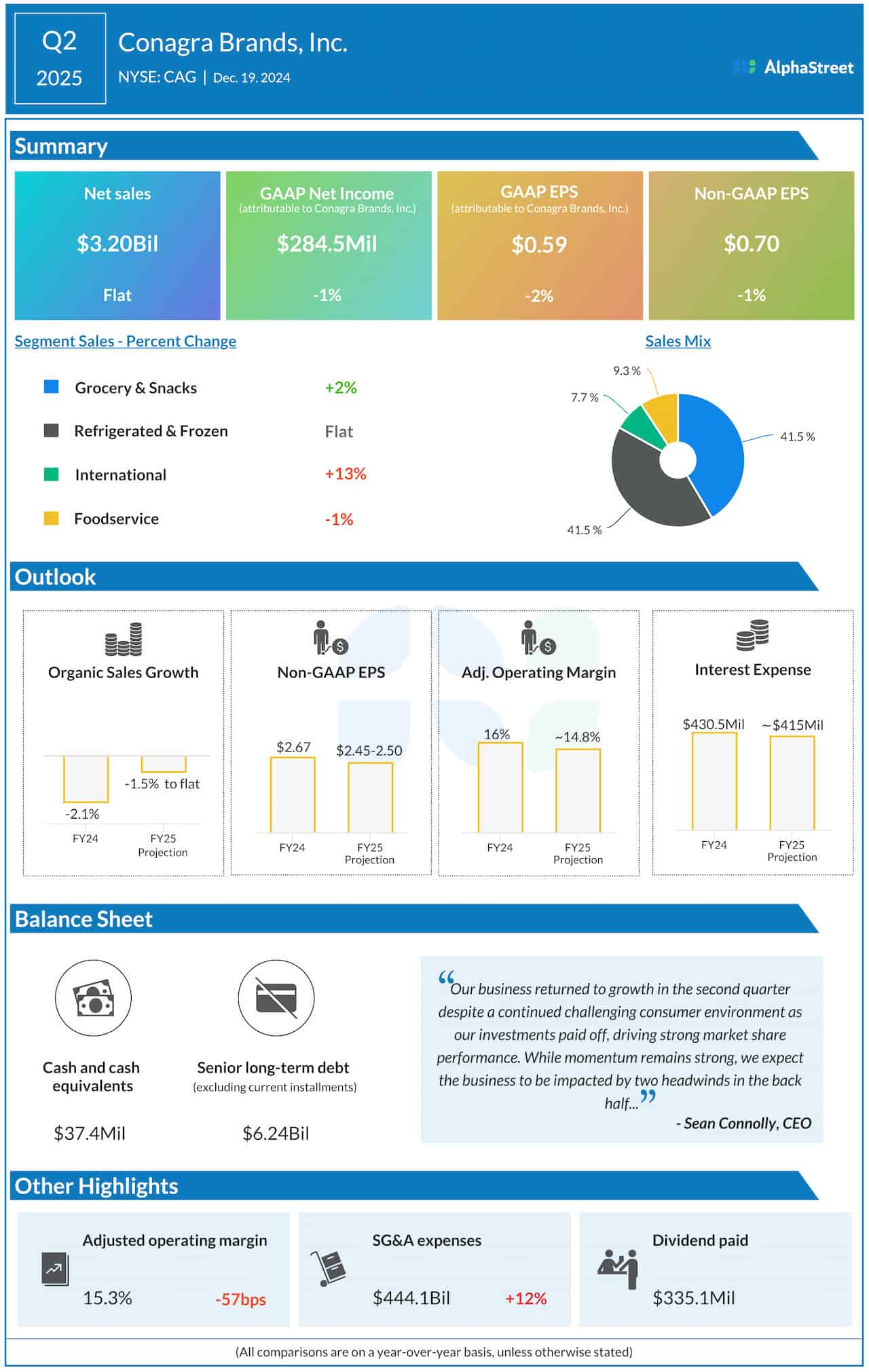

Despite the challenges, Conagra's recent quarterly results were impressive. The company reported a 25.8% increase in net sales, beating market expectations. This growth was driven by strong demand for its products and the benefits of its recent acquisitions. The company's adjusted EPS also rose to $0.75, surpassing the forecasted $0.73.

One of the key strategies that has helped Conagra overcome its challenges is the company's focus on innovation and product differentiation. By regularly introducing new products, the company is able to keep consumers engaged and maintain a competitive edge. Additionally, Conagra's effective marketing strategies and its decision to increase investments in e-commerce have been beneficial.

Yet, the impact of inflation is a significant concern for Conagra. The rising costs of raw materials and transportation have put pressure on the company's margins. Conagra has responded by implementing price increases and cost-saving measures. While this has helped offset some of the impact, it's clear that the inflationary environment will continue to be a challenge.

However, despite the obstacles, Conagra's future prospects look promising. The company's strong brand portfolio, combined with its strategic initiatives, position it well for future growth. Investors, too, seem to have confidence in the company's direction, with the stock up about 30% over the past six months.

In conclusion, while the current business environment presents several challenges, Conagra is successfully navigating these difficulties through a combination of innovation, strategic acquisitions, and effective marketing. The company's ability to adapt and evolve in the face of adversity is a testament to its resilience and potential for future success.