AI Sentiment: Very Bullish

Reason: MicroStrategy's aggressive Bitcoin investment strategy has resulted in a surge in trading volume and a 300% increase in its stock price, signifying growing acceptance of Bitcoin as a legitimate asset class.

The trading volume of MicroStrategy, an American software company, has seen a significant surge recently, rivaling that of the top seven US tech stocks. This surge in trading volume can largely be attributed to the company's investment strategy of converting its cash reserves into Bitcoin, which has caught the attention of both crypto enthusiasts and traditional investors. The company's bold strategy has positioned it as a de-facto Bitcoin play in the stock market.

Over the past six months, the average daily trading volume of MicroStrategy has escalated to levels comparable with major tech giants like Apple, Microsoft, Amazon, Alphabet, Facebook, Tesla, and Nvidia. The company has witnessed a 10-fold increase in daily trading volume, demonstrating investors' increasing interest in the company and its unorthodox approach to treasury management. This trend is indicative of the growing integration of the cryptocurrency market with traditional finance.

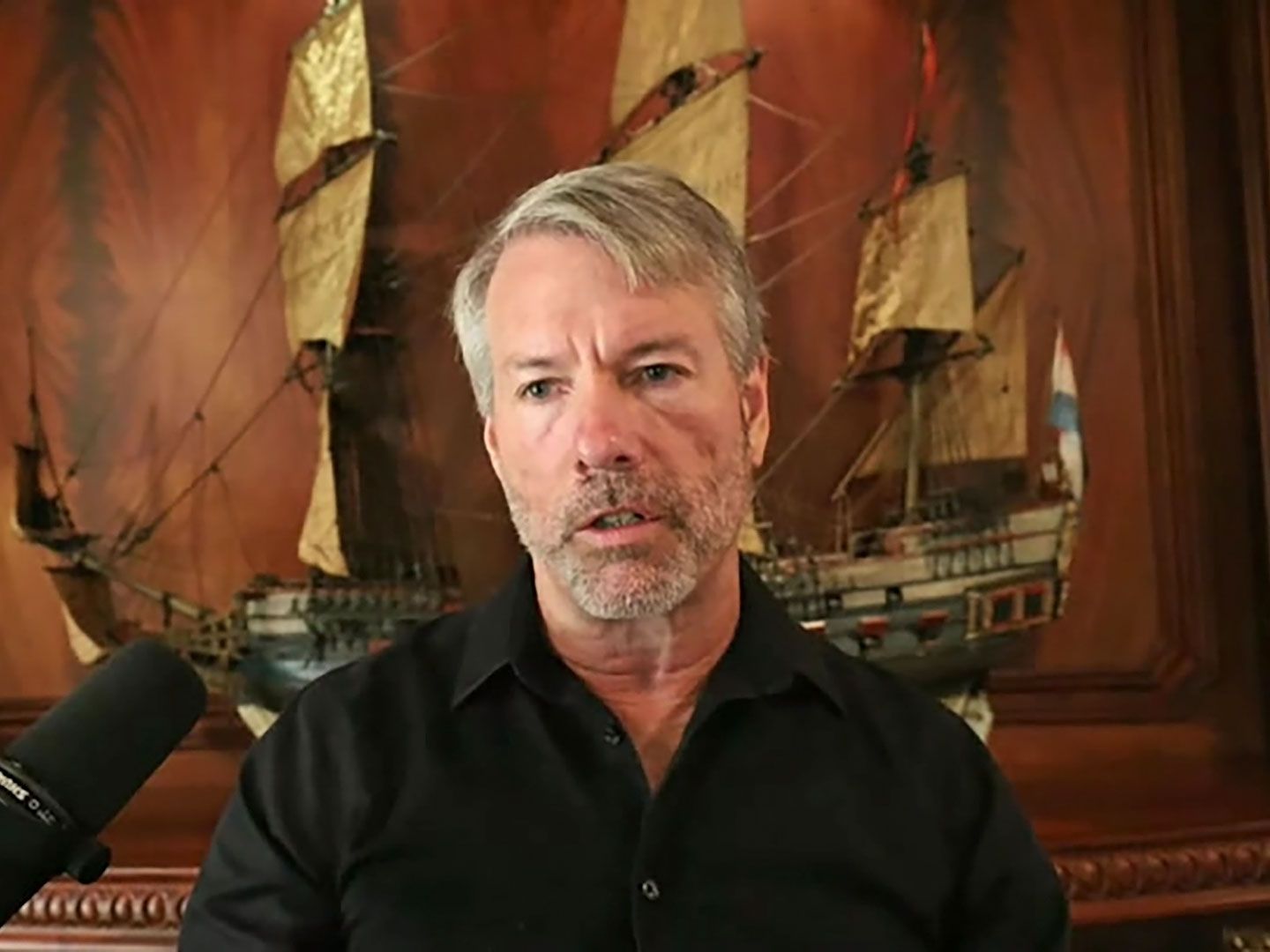

MicroStrategy started its Bitcoin buying spree in August 2020, when it invested $250 million into the cryptocurrency. The company has continued to purchase Bitcoin aggressively, leading it to currently own more than 70,000 Bitcoins, valued at approximately $2.4 billion. The CEO of MicroStrategy, Michael Saylor, has stated that the company plans to hold its Bitcoin investment for the long term, viewing the cryptocurrency as a superior asset class that will outperform cash in the long run.

The company's investment in Bitcoin has resulted in a sharp rise in its stock price. MicroStrategy's shares have surged more than 300% since it first announced its Bitcoin purchase. This success story has encouraged other companies to consider Bitcoin as a reserve asset. However, it should be noted that this strategy carries substantial risks due to the high volatility of the cryptocurrency market.

Despite the risks, the rise of MicroStrategy illustrates a broader trend of increasing institutional interest in Bitcoin. The integration of Bitcoin into traditional investment strategies signifies a transformative moment in the financial landscape, indicating Bitcoin's growing acceptance as a legitimate asset class.