AI Sentiment: Bullish

Reason: The article is optimistic about Mattel's growth strategy, which includes focusing on intellectual property, expanding its digital gaming presence, entering the film and television industry, and cost optimization. The company's brands are seeing strong demand and it is well-positioned for future growth.

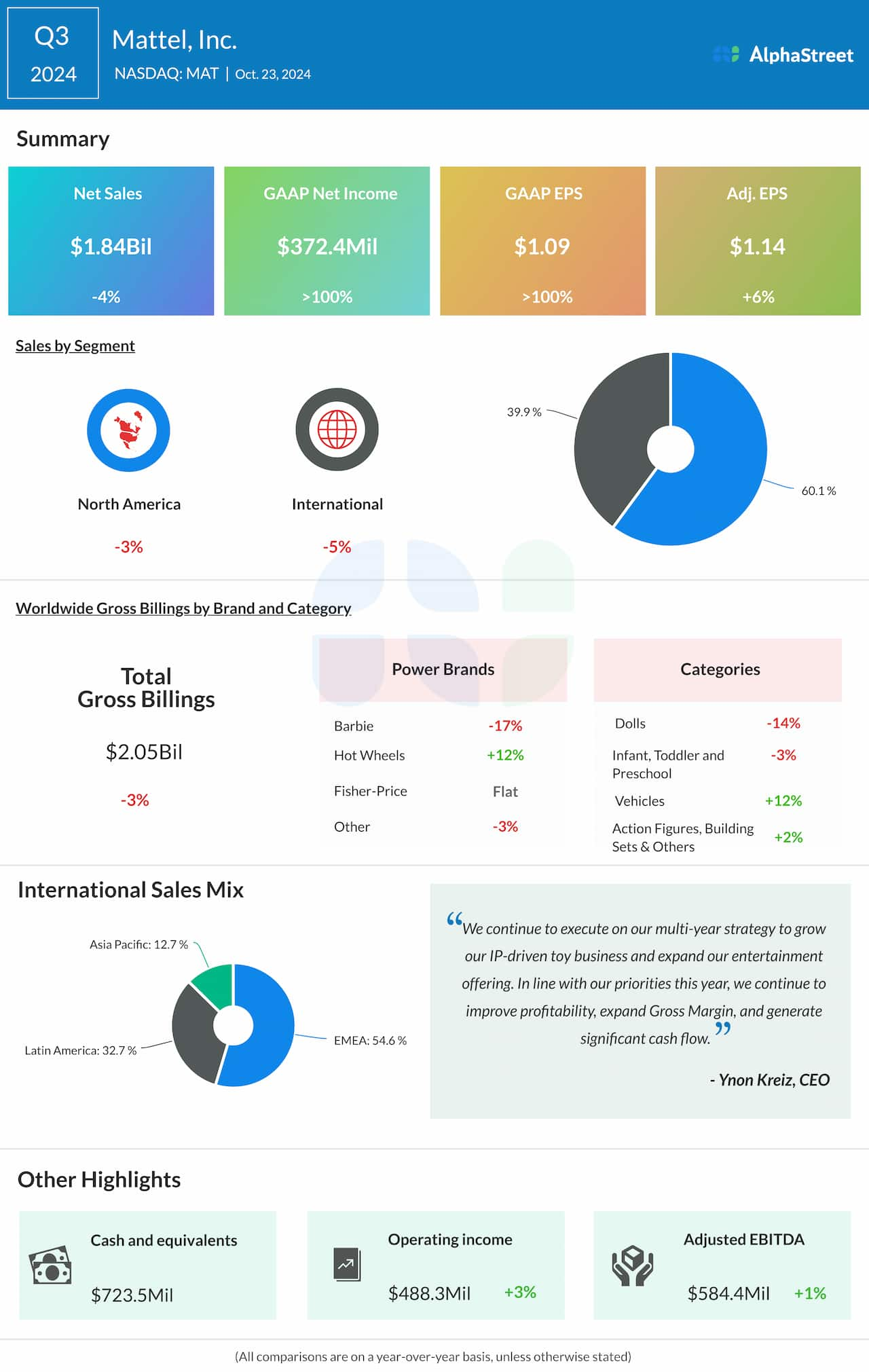

Renowned toymaker Mattel Inc. (MAT) has been steadily evolving its strategy, presenting various growth opportunities for the company. The current focus is on transforming Mattel into an intellectual property (IP) driven, high-performing toy company. The company's strategic roadmap includes creating a robust portfolio of franchises, optimizing cost structures, and driving toward a capital-light business model.

Mattel is best known for its iconic brands such as Barbie, Hot Wheels, Fisher-Price, and American Girl. All these brands have a strong consumer base and continue to see strong demand even during the pandemic. In addition, the company's sales have been driven by the pandemic-induced trend of heightened at-home activities.

As part of its growth strategy, Mattel is also focusing on expanding its digital gaming presence. The company's partnership with NetEase to develop digital games and educational apps based on its brands has proven to be fruitful. In addition, the company has been leveraging its IP across multiple platforms, including movies, TV, digital gaming, and live events.

Looking ahead, Mattel is also entering the film and television industry, as it sees significant potential in this area. The company has a vast amount of IP that it can utilize for content creation. There are already several projects in various stages of development, including films based on Barbie and Hot Wheels. These projects are expected to create a new revenue stream for the company and further boost its brand presence.

On the financial front, Mattel has been managing its costs effectively, leading to improved profitability. The company's Capital Light Strategy includes reducing capital expenditures, optimizing its manufacturing footprint, and focusing on a variable cost structure. This strategy has helped the company to improve its cash flow and strengthen its balance sheet.

In conclusion, Mattel is well-positioned for future growth with a strong portfolio of brands, a clear strategic roadmap, and a focus on cost optimization. The company has been successfully navigating the challenges posed by the pandemic and is poised to capitalize on the opportunities in the post-pandemic era.