AI Sentiment: Cautiously Bullish

Reason: Despite the recent 3.5% drop in Hedera Hashgraph (HBAR), the article maintains a cautiously optimistic view about the overall future of the cryptocurrency market.

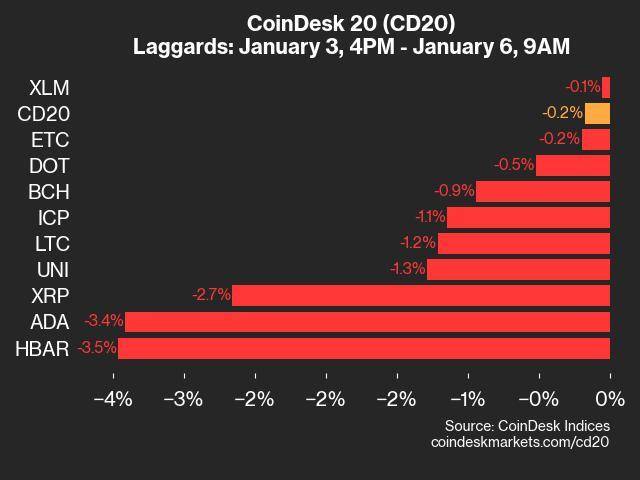

The cryptocurrency market recently saw a slight dip, with the CoinDesk 20 index trading lower than its previous Friday's position. Amongst the currencies included in the index, Hedera Hashgraph (HBAR) witnessed a significant drop of 3.5%.

The CoinDesk 20 index, which provides a real-time view of the largest cryptocurrencies by market capitalization, is a key indicator for crypto traders worldwide. It includes the most liquid and broadly invested cryptocurrencies, providing investors and traders with a comprehensive snapshot of the crypto market's health.

The recent dip in the index was led by the fall in Hedera Hashgraph (HBAR). HBAR is a digital currency used in the Hedera public network. The network is built on a Hashgraph distributed ledger that enables individuals and businesses to create powerful decentralized applications. It is known for its high-speed transactions and security. This 3.5% drop in HBAR's value marks a significant movement given its influence in the market. However, it's important to note that the crypto market is highly volatile and such fluctuations are not uncommon.

Despite this minor setback, the cryptocurrency market continues to develop and expand, attracting a variety of investors. The advent of cryptocurrencies and blockchain technologies has revolutionized the financial landscape, enabling faster and more secure transactions. Crypto assets like HBAR are at the forefront of this revolution, and despite the occasional fluctuations, the overall trajectory seems promising.

It's essential for potential investors and current traders to monitor these changes in the market. By keeping an eye on the CoinDesk 20 index, investors can stay informed about the market's overall direction and make informed decisions about their investments. As always, however, individuals should carefully consider their risk tolerance and investment goals before diving into the crypto market.