AI Sentiment: Bullish

Reason: The article highlights IBM's strong performance and growth prospects for the future. The company's focus on innovative technologies such as AI, cloud computing, and quantum computing, along with the strategic shift towards more profitable areas, underpin its positive outlook.

In an increasingly digitalized world, tech giant IBM has been making significant strides. The company's performance in 2020 was notably positive, and its prospects for the year 2025 look equally promising. IBM's growth is largely attributed to its focus on innovative technologies such as artificial intelligence (AI), cloud computing, and quantum computing.

The year 2020 was a transformative period for IBM, marked by a significant shift in its business strategy. The company spun off its legacy IT infrastructure service business, called Kyndryl, to focus more on high-margin businesses like cloud computing and AI. The spin-off allowed IBM to accelerate its transition towards a more sustainable and profitable business model.

In the coming years, IBM is expected to continue its growth trajectory, largely driven by its investment in cloud computing. With a market share of over 6%, IBM is considered one of the top players in the global cloud infrastructure market, which is projected to grow significantly in the coming years. The company's cloud strategy revolves around its Red Hat acquisition, which has helped it establish a strong foothold in the hybrid cloud market.

Moreover, IBM is also investing heavily in AI and quantum computing, positioning itself as a leading player in these emerging fields. The company's AI platform, Watson, is widely recognized for its advanced capabilities and is being used in various industries. On the other hand, IBM's quantum computing efforts are still in the early stages, but the company is making significant progress and has already launched a quantum computer called IBM Q.

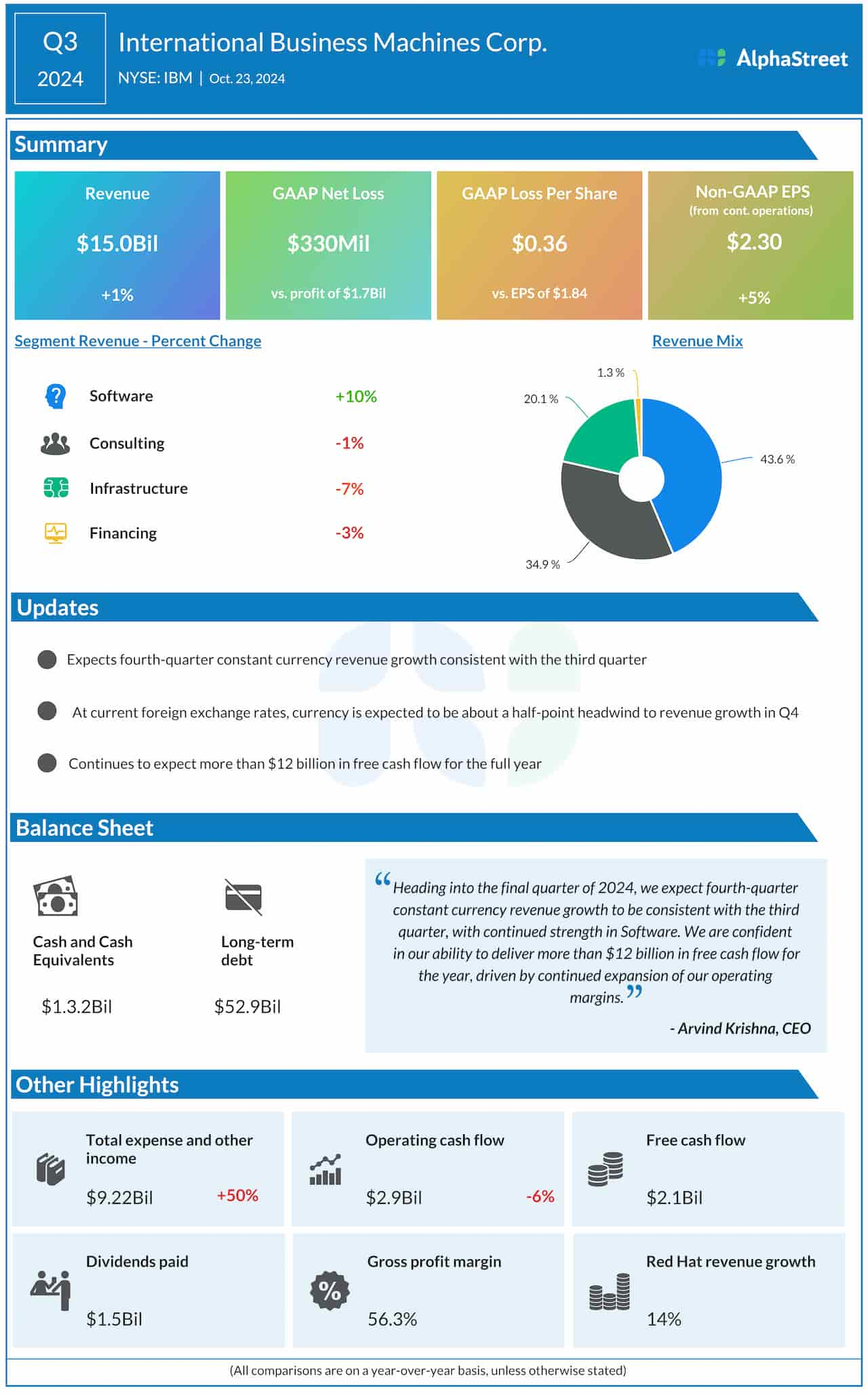

Financially, IBM has shown resilience amidst the global pandemic and has maintained a healthy cash flow. It is expected that the company's revenue will grow at a compound annual growth rate (CAGR) of around 1% until 2025, reaching approximately $75 billion. Profitability is also expected to improve, with the company's operating margin projected to increase from 12.5% in 2020 to 14% in 2025.

In conclusion, the future looks bright for IBM as it continues to innovate and invest in high-growth areas. The company's strategic shift towards more profitable sectors, along with its strong market position, are likely to drive its growth and profitability in the coming years.