AI Sentiment: Cautiously Bullish

Reason: Despite struggles in Constellation Brands' wine and spirits business, their investments in cannabis and expansion of premium beer portfolio are expected to drive long-term growth, showing a cautiously optimistic outlook.

Constellation Brands, a leading beverage alcohol company, is set to report its third-quarter earnings on January 9. Prior to the announcement, there are few key factors to consider that might have influenced the company's performance during this period.

The company has been investing heavily in the cannabis industry through its partnership with Canopy Growth. While this decision might have resulted in short-term pressure on margins and earnings, it holds potential for long-term growth. Furthermore, Constellation Brands has also been focusing on expanding its premium beer portfolio which has so far been a huge success, driving solid growth for the company.

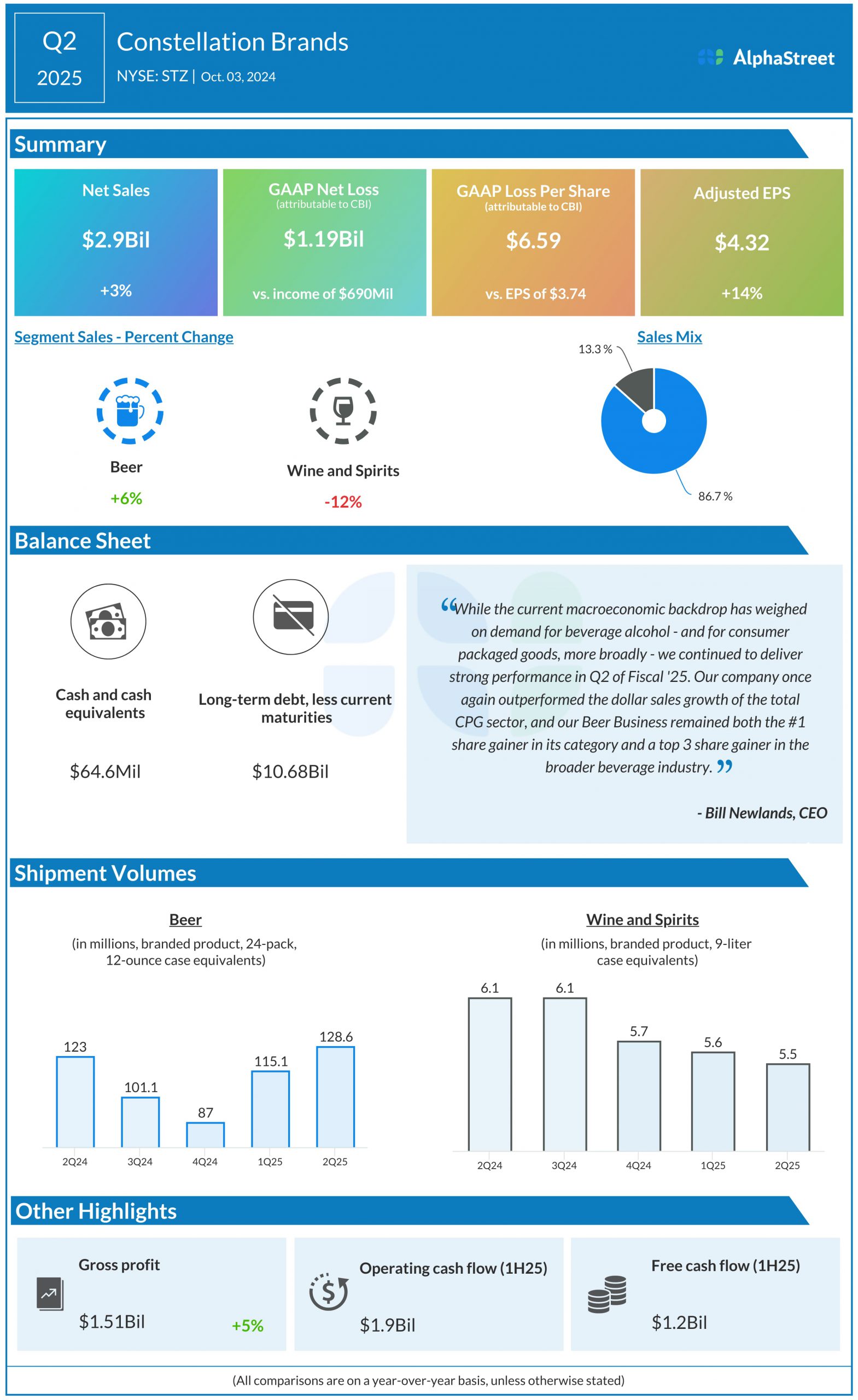

In the past quarters, the winemaker has been struggling with its wine and spirits business. The company's strategy to sell some of its low-end wine brands to E. & J. Gallo Winery has been delayed due to regulatory concerns, which could have impacted the third quarter results. Despite this, it is expected that the company's high-end spirits and premium beer products will continue to perform well.

Constellation Brands continues to see robust market trends in the U.S. beer category. This is expected to have contributed to the company's beer business growth in the third quarter. The Modelo and Corona brand families are believed to have delivered strong portfolio performance and gained market share during this period.

Analysts expect Constellation Brands to report earnings of $1.85 per share on revenue of $1.95 billion for the third quarter. In the same quarter last year, the company reported earnings of $2.37 per share on revenue of $1.97 billion. The company has a strong track record of beating earnings estimates and it will be interesting to see if it can continue this trend in the upcoming announcement.

Overall, while challenges persist in the wine and spirits business, the company's beer business and cannabis investments are expected to drive growth in the long term. The announcement of the third quarter results will provide insights into the company's performance and future strategy.