AI Sentiment: Bullish

Reason: BlackBerry's Q3 2025 financial report shows significant improvements in performance and revenue growth, despite net losses. It also maintains a healthy liquidity position, indicating steady progress and potential for continued growth.

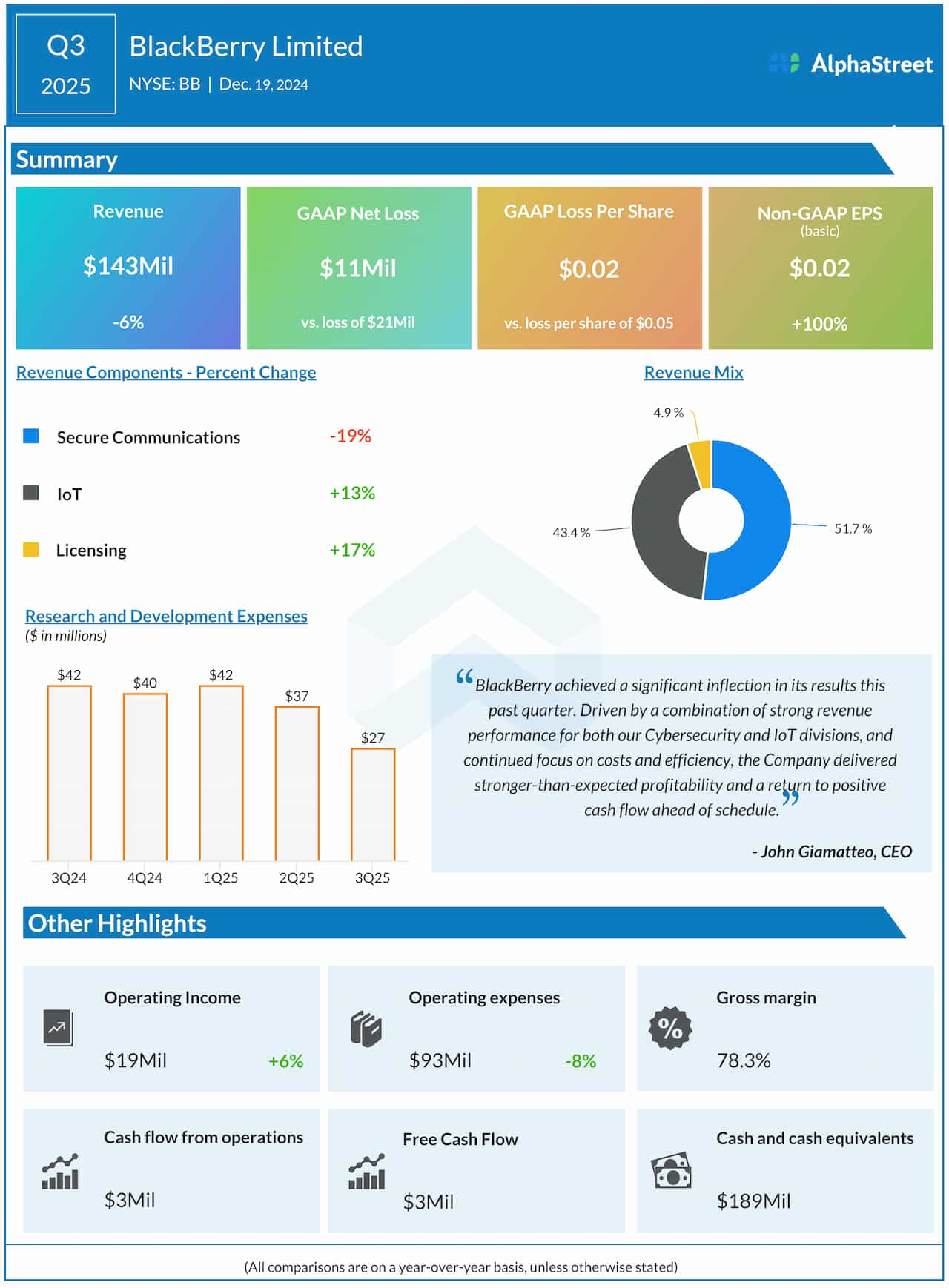

In a recent financial report, BlackBerry has announced its Q3 2025 results, marking significant developments in its performance. The technology company, known for its focus on software and services, has been making efforts to transform and reposition itself in the market, and the latest financial data indicates positive outcomes.

During the third quarter, BlackBerry's total revenue reached $218 million, a clear increase compared to the same quarter in the previous year. The company's gross margin stood at 71%, up from 70% in the second quarter. These results indicate an upward trend in BlackBerry's financial performance, suggesting that the company's strategic decisions are producing beneficial results.

Furthermore, the company's software and services revenue reached $182 million, reflecting BlackBerry's commitment to solidifying its position in this sector. The amount was mostly recurring, which shows the company's ability to generate consistent income in this area. BlackBerry's net loss, however, stood at $130 million or $0.23 per share in Q3, a significant increase from $32 million or $0.07 per share in the previous year.

Despite this, the company's cash, cash equivalents, and investments were reported to be $849 million at the end of the quarter. This demonstrates that BlackBerry maintains a healthy liquidity position that can support its ongoing operations and investments in growth.

Under the leadership of John Chen, BlackBerry's Executive Chairman and CEO, the company continues to focus on long-term growth. Chen acknowledged the company's improved revenue and gross margin and emphasized BlackBerry's ongoing commitment to focusing on its key markets. He also highlighted the company's intent to drive shareholder value over the long haul.

BlackBerry's financial results for Q3 2025 reflect a successful transition towards a software and services focused business model. Despite net losses, the company's revenue growth and the increase in gross margin show that BlackBerry is making steady progress in its strategic transformation. With a solid cash position and a clear vision for the future, BlackBerry is poised for continued growth in the coming years.