AI Sentiment: Bullish

Reason: Micron's Q1 2025 report shows financials surpassing market expectations driven by high demand for its memory products. Despite potential global chip shortage and supply chain disruptions, the company remains optimistic about its performance.

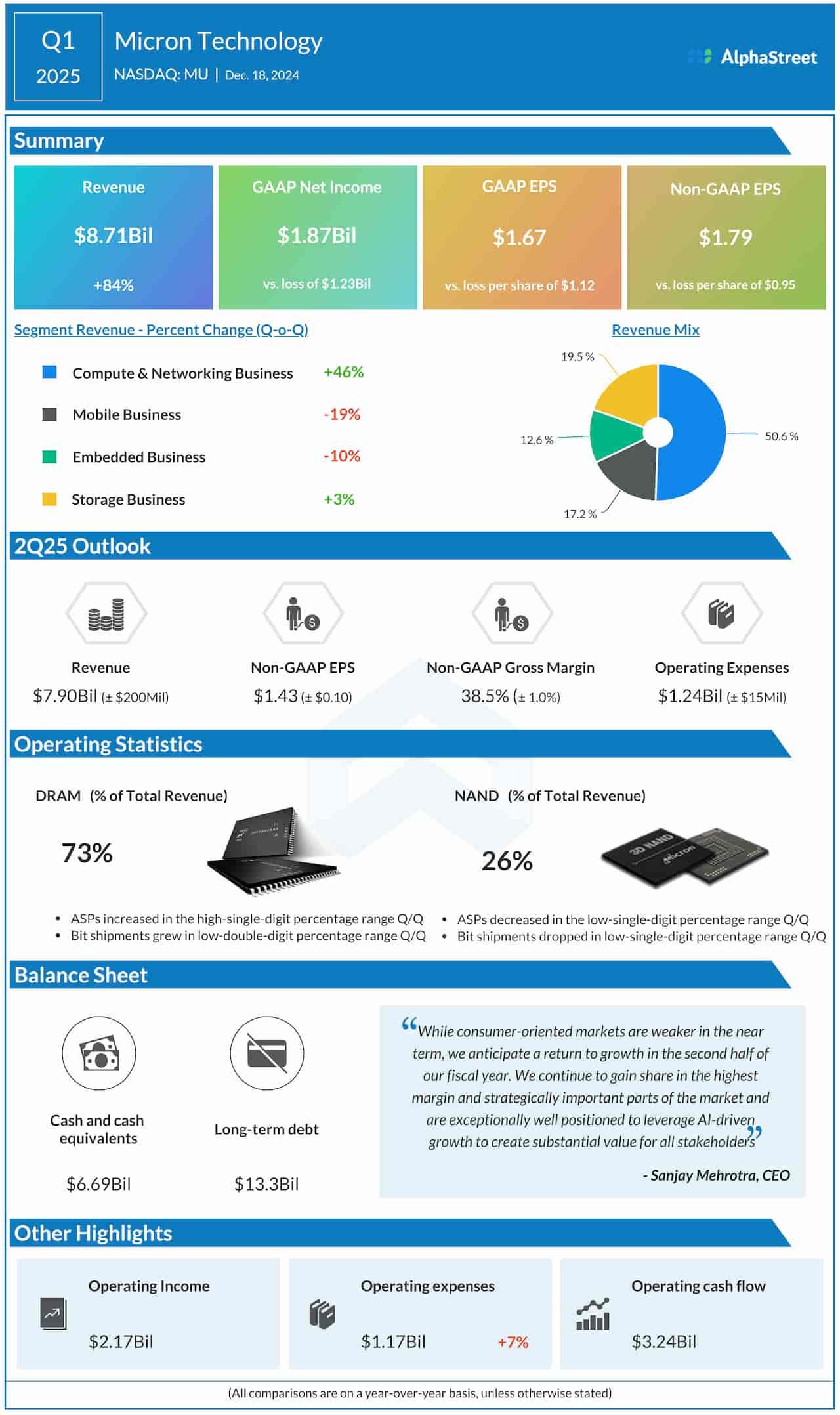

In its Q1 2025 report, Micron, a leading global provider of memory and storage solutions, announced its financial results, which surpassed expectations. The company's robust performance was primarily driven by the strong demand for its DRAM and NAND flash memory products, bolstering the top-line growth.

For the first quarter of 2025, Micron reported a profit of $1.69 per share, significantly exceeding the market's expectations. The company's revenue for the quarter was $7.91 billion, also surpassing the market's prediction. It represented an increase of 27% compared to the same period in the previous year. The revenue surge was mainly attributed to the heightened demand for memory chips, especially from the data center and smartphone sectors. Furthermore, Micron's gross margin expanded to 45%, reflecting the improved pricing environment.

Micron has been investing heavily in research and development to stay ahead of its competitors in the fast-paced and ever-evolving semiconductor industry. The company's efforts in transitioning to the 1-alpha node for DRAM production and the 176-layer for NAND production have started to pay off, with the new technologies contributing significantly to both the top and bottom lines.

Looking forward to the second quarter of 2025, Micron anticipates revenue in the range of $7.8 billion to $8.2 billion, with a gross margin of about 46-48%. With the ongoing digital transformation trends and the accelerated shift towards a remote-first environment, the demand for data storage and memory solutions is expected to remain high. Micron is well-positioned to benefit from these trends and continue its growth trajectory in the coming quarters.

However, the company also acknowledged the potential challenges posed by the ongoing global chip shortage and supply chain disruptions. Despite these challenges, Micron remains optimistic about its performance, given its robust product portfolio, innovative capabilities, and strong demand across various end markets.