AI Sentiment: Bullish

Reason: Despite facing inflationary pressures and supply chain disruptions, General Mills reported solid Q2 2025 earnings results, showcasing robust sales growth and effective cost management strategies. The company's future plans also indicate a commitment to sustainable growth.

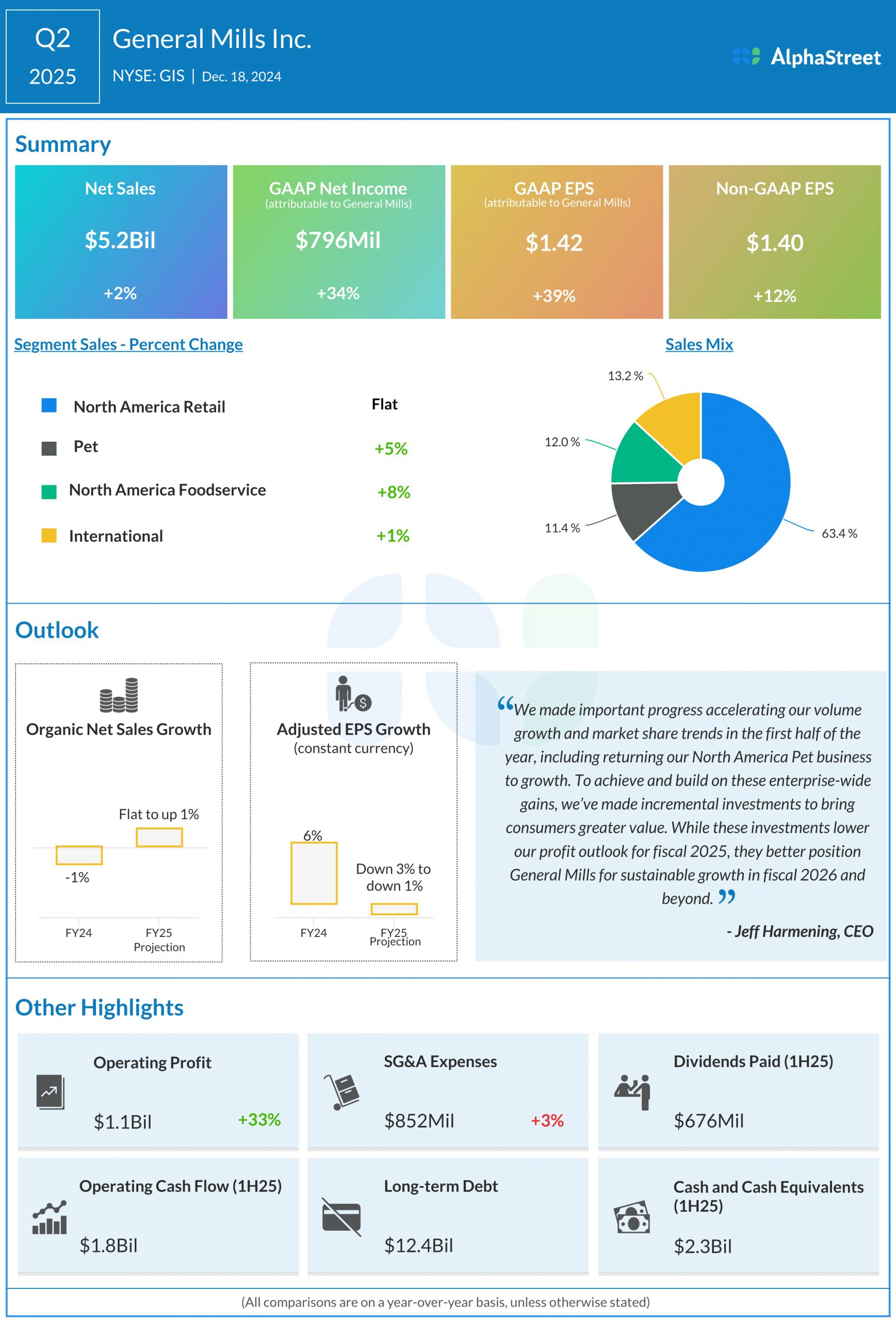

General Mills, a world-leading food company, recently released its Q2 2025 earnings results, which offered some interesting insights into the company's performance and future plans. The renowned food producer reported robust sales growth, backed by the strong performance of its pet foods, convenient meals, and cereal segments. Despite some inflationary pressures and supply chain challenges, the company managed to deliver solid results, showcasing its resilience in a challenging environment.

In the second quarter, net sales increased by 3% to $5 billion, while the operating profit margin was 17.1%. Organic net sales increased by 1%, reflecting increased contributions from volume and positive price/mix. However, the company's gross margin was down 210 basis points, owing to higher input costs and supply chain disruptions. The adjusted diluted earnings per share were $0.99, down 4% from the year-ago quarter.

General Mills continues to see strong demand for its products across various segments. The pet foods segment continues to be a significant growth driver, fueled by strong sales of BLUE. The convenient meals segment also performed well, thanks to strong sales of Progresso soup and Totino's. Meanwhile, the cereal segment benefited from strong sales of Cheerios and Cinnamon Toast Crunch.

Looking forward, General Mills expects organic net sales growth in the range of 2-3% for fiscal 2025. The company is focused on driving sustainable sales growth and expanding its margins through cost savings and efficiency improvements. However, the company anticipates continued pressure from higher input costs and supply chain disruptions in the near term. The management is actively working on mitigating these challenges through pricing actions and productivity efforts.

Overall, General Mills' Q2 2025 earnings results highlight the company's strong execution and ability to navigate through challenging market conditions. Despite some headwinds, the company continues to deliver solid financial performance, backed by strong demand for its products and effective cost management strategies. Going forward, the company plans to continue investing in its brands and innovation to drive sustainable growth.